Contents

It then started using a wider set of options based on the broader S&P 500 Index, an expansion that allows for a more accurate view of investors’ expectations of future market volatility. A methodology was adopted that remains in effect and is also used for calculating various other variants of the volatility index. VIX is a real-time market index that measures the market’s estimate of volatility over the next 30 days. When making investing decisions, investors use the VIX to gauge the amount of risk, worry, or tension in the market.

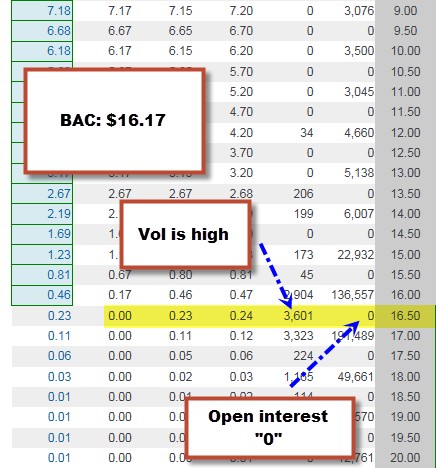

All such qualifying options should have valid nonzero bid and ask prices that represent the market perception of which options’ strike prices will be hit by the underlying stocks during the remaining time to expiry. The Cboe Volatility Index is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index . Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility.

What It Means for Individual Investors

TJ has a bachelor’s in business administration from Northeastern University. To hedge a long portfolio one could purchase call options or take a long VIX future position. The general idea is if the long portfolio declines sharply in price the VIX will rise in price and the call options would increase in value. This is a typical hedging method use for large long basket positions. The VIX options and futures can be used to both hedge a long portfolio or even used to take a position in the VIX.

The CBOE Volatility Index—also known as the VIX—is a primary gauge of stock market volatility. The VIX volatility index offers insight into how financial professionals are feeling about near-term market conditions. Understanding how the VIX works and what it’s saying can help short-term traders tweak their portfolios and get a feel for where the market is headed. A VIX of greater than 20% signifies increasing uncertainty and fear in the market and implies a higher-risk environment. During the 2008 Financial Crisis, the volatility index skyrocketed to extreme levels of above 50%.

The VIX is a great leading indicator for volatility with options. When you learn how to the VIX with your trading, you’ll be that much better as a trader. Thus, if the VIX were to increase today, the number of patterns identified by screeners would be reduced, and with the same number of traders trading the stocks, these patterns would be overtraded, and less profitable.

Options are a derivative of instruments where prices depend upon the chances of a specific stock’s current price. This level is also known as exercise price, or more commonly as the strike price. In India, high market volatility and absence of other developed products to hedge volatility risks may make IndiaVix a success.

Alternatively, you could adjust your asset allocation to cash in recent gains and set aside funds during a down market. SPX options are a combination of standard SPX options that expire on the third Friday of each month and weekly SPX options that expire on all other Fridays. To be included, an option must have an expiry date between 23 and 37 days from the time of calculation.

He is a professor of economics and has raised more than $4.5 billion in investment capital. If the VIX heads higher than 20, then fear is starting to enter into the market and it is forecasting a higher risk environment. If it goes too high, then everyone is singing the “chicken little” song. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited. Vix calculated a measure of the calculated rate of the volatility of no more than ten S&P 100.

How to Trade the VIX

Meaning of Volatility Index – Volatility Index is a key measure of market expectations of near term volatility. Thus when the markets are highly volatile, market tends to move steeply up or down and during this time volatility index tends to rise. VIX is sometimes also referred to as the Fear Index because as the volatility index rises, one should become fearful or I would say careful as the markets can move steeply into any direction. Worldwide, VIX has become an indicator of how market practitioners think about volatility. Investors use it to gauge the market volatility and make their investment decisions. With IG, you can use CFDs to take a position on the movement of the VIX, as well as VIX futures and exchange traded funds .

Ajit Mishra, VP – Technical Research, Religare Broking Markets witnessed profit taking on the final trading day of the calendar… Taking Stock | Sensex, Nifty end last session of 2022 in the red; PSBs, metal stocks shine… The relationship between the S&P 500 and the VIX has largely been consistent and reliable over the years, though. The rolling 1-year correlation between daily changes has on average been around -83% over the past 10 years, staying within a relatively tight range of -70% to -90%. Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters.

FAQs on India VIX

Investing in a put option is like betting that the price of a stock will go down before the put contract expires because puts give investors the right to sell shares of a stock on a specific date at a specific price. The CBOE Volatility Index is an index designed to track the volatility of the United States stock market. Specifically, it aims to track the expected volatility of the S&P 500 through call and put options. Indices scale new highs on strong global cues; Nifty closes above 18,600Foreign portfolio investors net bought Indian shares worth ₹1,241.57 crore on Tuesday, showed provisional data from the stock exchanges.

- Despite your belief in its long-term potential, you’d want to limit your exposure to any potential volatility in the stock price in the near term.

- Options are a derivative of instruments where prices depend upon the chances of a specific stock’s current price.

- At the extremes we see that it is wrong and quickly tries to compensate, as buyers quickly become sellers or sellers quickly turn into buyers.

- $15-25, there is typically a moderate amount of volatility, but nothing extreme.

- The fact that this metric represents expected volatility is very important.

The Chicago Board Options Exchange’s Volatility Index is commonly known as the VIX. Although VIX levels can be very high during times of crisis, extreme levels are rarely sustained for extended periods of time. This is because the market conditions lead traders to take actions to reduce their risk exposure . That, in turn, reduces the levels of fear and uncertainty in the market. As a rule of thumb, VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk, and investors’ fear. VIX values below 20 generally correspond to stable, stress-free periods in the markets.

How Does the VIX Measure Market Volatility?

From the chart above it’s easy to see the strongly negative correlation between the stock market and the VIX. Dating back the beginning of the VIX in 1990, the correlation between daily changes in the S&P 500 and VIX is -77%. Over the past 10 years the inverse correlation has become even stronger at -81%, while prior to October 2008 it was -74%. Implied volatility goes up when there is strong demand for options, and this typically happens during declines in the price of the S&P 500 as market participants are quick to buy protection for their portfolios.

The CBOE Volatility Index, or VIX, is the most recognized tool to trade financial market volatility. It measures 30-day expected or forward-looking volatility of the U.S. stock market based on the S&P 500 options. Call options give the buyer the right to buy a stock at a specified price during a specific period of time while put options give buyers the right to sell a stock at a specified price during a specific period of time. Prices are weighted to gauge whether investors believe the S&P 500 index will be gaining ground or losing value over the near term. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S.

However, shorting volatility is inherently risky, as there is the potential for unlimited loss if volatility spikes. The current volatility cannot be known ahead of time, so the VIX is best used in tandem with historical analysis of support and resistance lines. A common mistake when reading the VIX is that it tells us whether the S&P 500 is being bought or sold. While the VIX and S&P 500 do usually have an inverse relationship, the VIX is a measure of volatility itself – and in theory these price movements could go both ways.

VIX and volatility

The normal range for the VIX is values ranging between 12 and 20. Forbes advises investors that when the VIX is below a value of 20, that is reflective of a stable investment environment. A VIX value of 12 or lower is indicative of high optimism in the stock market — the mark of extremely bullish investor sentiment. All of these things are causing the storm clouds to gather around the possibility of recession. The Chicago Board of Options Exchange Volatility Index, or VIX, is a gauge for stock market volatility and investor sentiment. 71.6% of retail investor accounts lose money when trading CFDs with this provider.

Even if you don’t get involved in securities and derivatives based on the VIX, you can use the index as a useful indicator for other trades. Just like other forms of insurance, Trading Floor Technology the greater the risk the higher the premiums, and the lower the risk the lower the premiums. When the options premium fall the VIX falls and when premiums rise the VIX rises.

Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, https://1investing.in/ and past performance is not a guarantee of future performance. Trading financial products may not be available in your country or are only available for professional traders.